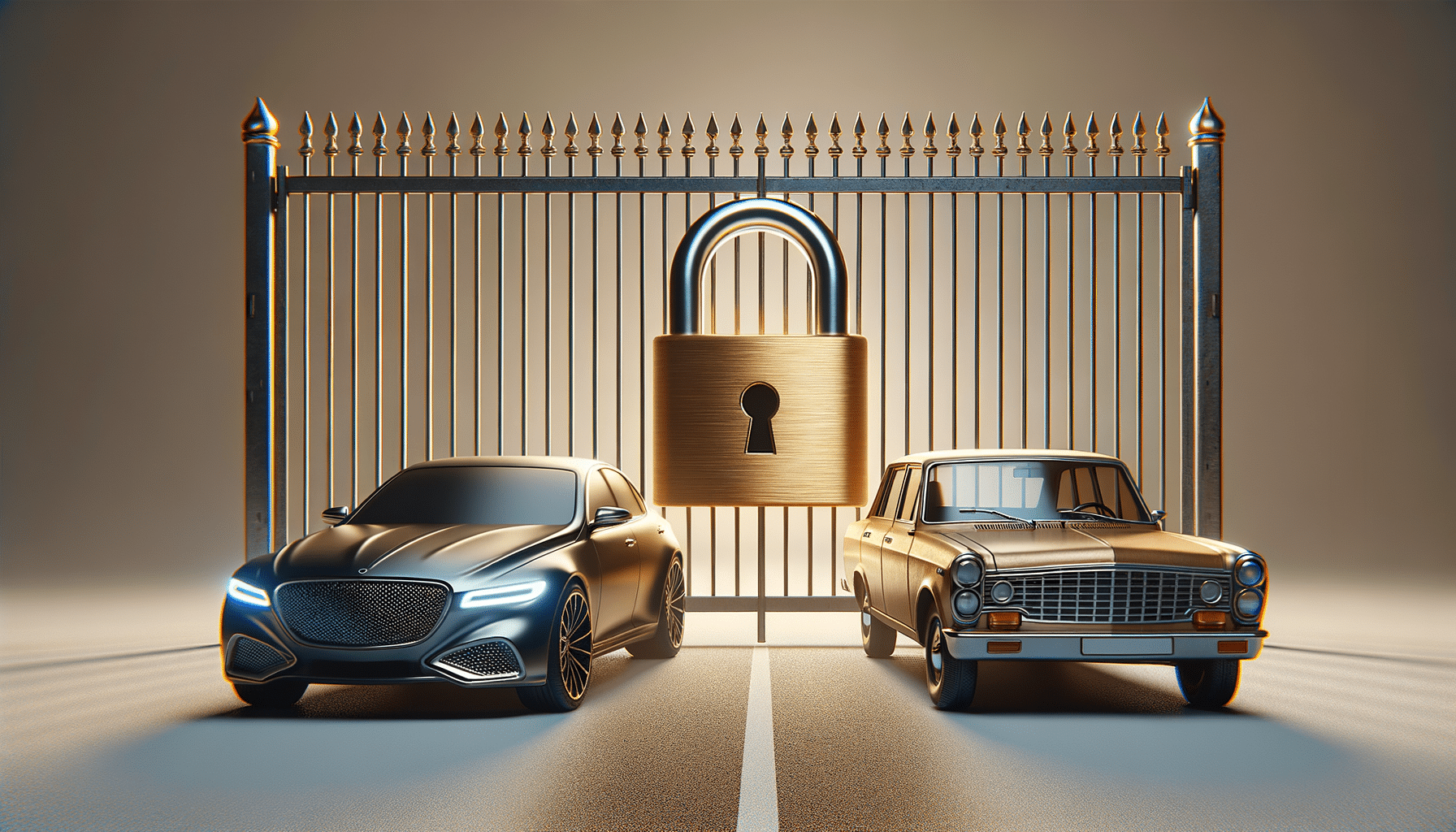

Unlocking Car Insurance Insights for Savings

Introduction to Car Insurance

Car insurance is more than just a legal requirement; it’s a financial safety net that can protect you from unexpected expenses. Understanding the intricacies of car insurance can make a significant difference in the coverage you receive and the premiums you pay. This article delves into the secrets of car insurance, offering insights into how you can secure affordable coverage while ensuring you are adequately protected.

Understanding the Basics of Car Insurance

Car insurance is designed to cover financial losses related to your vehicle. It typically includes liability coverage, which is mandatory in most places, and may also offer comprehensive and collision coverage. Liability insurance covers damages to other people and property if you’re at fault in an accident. Comprehensive coverage protects against non-collision-related incidents, such as theft or natural disasters, while collision coverage takes care of damages to your car from accidents.

When choosing a policy, it’s important to consider factors such as your car’s value, your driving habits, and your financial situation. Higher coverage limits offer more protection but come with higher premiums. On the other hand, policies with lower limits and higher deductibles can reduce your monthly costs but may leave you vulnerable to larger out-of-pocket expenses in the event of a claim.

To make informed decisions, it’s crucial to understand the different types of coverage available and assess your individual needs. Consider factors like your driving record, the age and condition of your vehicle, and your geographic location, as these can all influence your insurance requirements and costs.

Car Insurance Secrets Revealed

There are several “secrets” to securing more affordable car insurance that many drivers are unaware of. One key strategy is to regularly compare insurance quotes from different providers. Insurance companies use various algorithms to calculate premiums, and prices can vary significantly between providers for the same coverage.

Another secret is to take advantage of available discounts. Many insurers offer discounts for safe driving records, bundling multiple policies, or installing safety features in your vehicle. Additionally, maintaining a good credit score can also lower your insurance costs, as insurers often use credit information to assess risk.

Furthermore, consider adjusting your coverage based on your current situation. For instance, if you have an older vehicle, you might opt to drop collision coverage, as the cost of the premium could exceed the car’s value. By tailoring your policy to fit your needs, you can avoid paying for unnecessary coverage.

Finding Affordable Car Insurance

Securing affordable car insurance requires a proactive approach. Start by assessing your coverage needs and determining what you can afford in terms of premiums and deductibles. Use online comparison tools to gather quotes from multiple insurers, allowing you to evaluate the best options available.

Consider increasing your deductible to lower your premium. While this means you’ll pay more out-of-pocket in the event of a claim, it can significantly reduce your monthly costs. Additionally, explore discounts that you may qualify for, such as those for low mileage, being a member of certain organizations, or completing a defensive driving course.

Another strategy is to maintain a clean driving record. Avoiding accidents and traffic violations can help keep your premiums low. If you have a history of violations, consider taking a driving course to improve your skills and demonstrate your commitment to safe driving, which can help reduce insurance costs over time.

Conclusion: Making Smart Insurance Choices

Car insurance is a necessary expense, but it doesn’t have to be a financial burden. By understanding the basics of car insurance, uncovering industry secrets, and exploring ways to find affordable coverage, you can make informed decisions that protect your finances and provide peace of mind. Regularly reviewing and adjusting your policy as your needs change is crucial to ensuring you have the right level of coverage at the right price. Remember, the key to unlocking savings lies in being proactive, informed, and strategic about your car insurance choices.