The Importance of Regularly Checking Your Credit Score and Understanding Its Influences

Understanding the Basics of Credit Scores

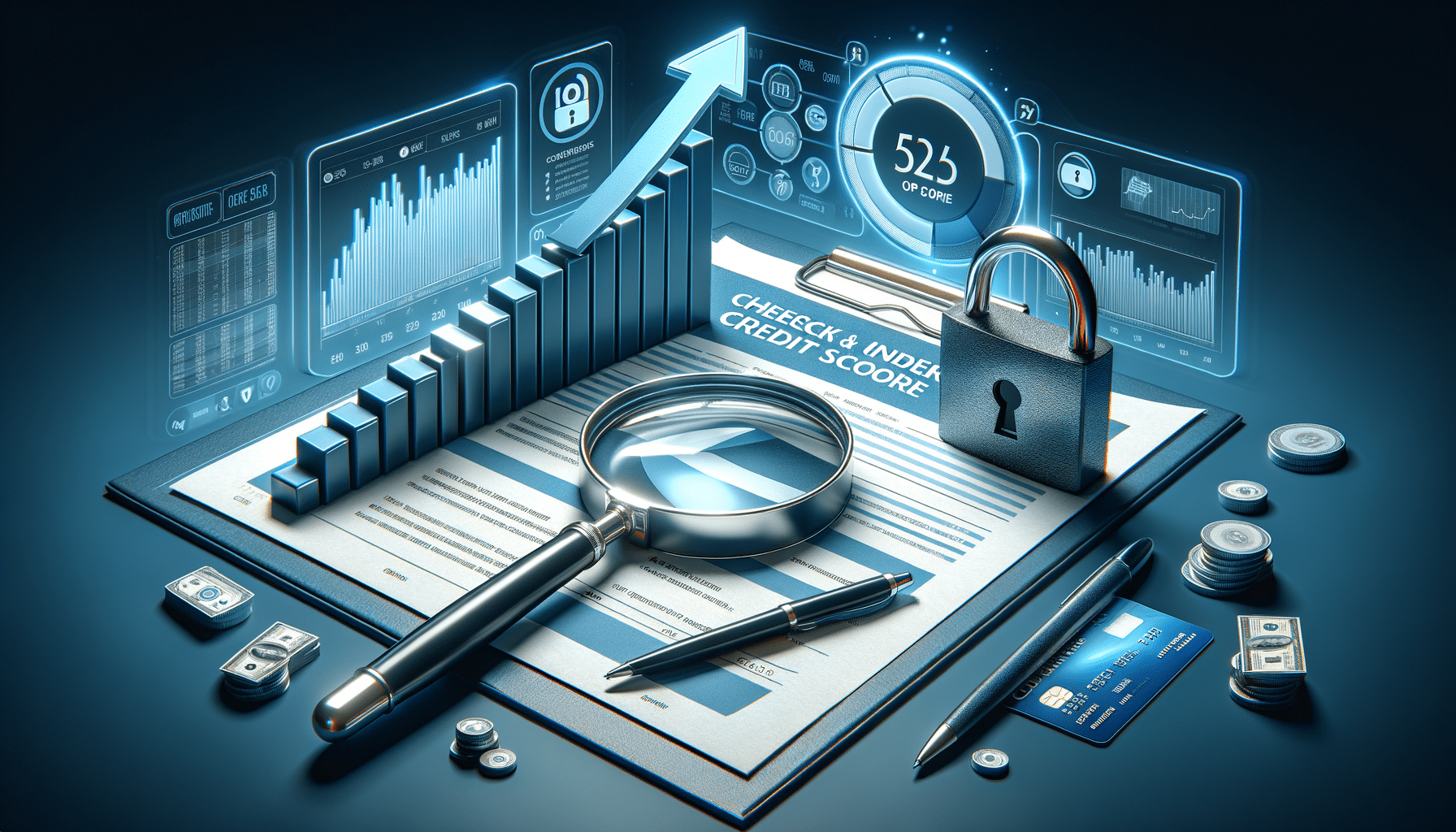

Credit scores are an integral part of financial health, serving as a numerical representation of a person’s creditworthiness. These scores are used by lenders to evaluate the risk of lending money or extending credit. Typically, credit scores range from 300 to 850, with higher scores indicating better creditworthiness. Understanding the basics of credit scores is crucial for anyone looking to make informed financial decisions.

Credit scores are calculated based on several factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used. Each of these components plays a significant role in determining the overall score. For instance, a strong payment history can positively impact your score, while high amounts owed might lower it.

It’s essential to regularly check your credit score to ensure accuracy and to identify any potential issues early. This proactive approach can help in maintaining or improving your score, ultimately affecting your ability to secure loans, credit cards, and even housing.

The Importance of Checking Your Credit Score

Regularly checking your credit score is a vital practice for maintaining financial health. It allows you to understand your current financial standing and identify areas for improvement. By keeping an eye on your credit score, you can spot inaccuracies or fraudulent activities that may negatively impact your score.

Checking your credit score frequently can also prepare you for major financial decisions. Whether you’re planning to apply for a mortgage, car loan, or credit card, knowing your credit score can help you anticipate the terms and conditions you might be offered. A higher score often translates to better interest rates and loan terms, saving you money in the long run.

Moreover, regularly monitoring your credit score can motivate you to adopt better financial habits. It encourages timely bill payments, reduces unnecessary debts, and promotes responsible credit usage, all of which contribute positively to your credit score.

Factors Affecting Your Credit Score

Several factors influence your credit score, each contributing differently to the overall calculation. Understanding these factors can help you manage your credit more effectively and improve your score over time.

Firstly, payment history is one of the most significant factors, accounting for about 35% of your score. Consistently paying bills on time can positively impact your credit score, while late payments can have adverse effects. Secondly, the amounts owed, or your credit utilization ratio, makes up about 30% of your score. Keeping your credit card balances low relative to your credit limit is crucial for maintaining a healthy score.

Other factors include the length of your credit history, which accounts for 15% of your score. A longer credit history generally indicates reliability, positively affecting your score. Additionally, new credit and types of credit used each contribute 10% to your score. Opening several new credit accounts in a short period can lower your score, while having a mix of credit types, such as credit cards, retail accounts, and installment loans, can boost it.

How to Improve Your Credit Score

Improving your credit score is a gradual process that requires consistent effort and financial discipline. One effective strategy is to pay your bills on time, as payment history significantly impacts your score. Setting up automatic payments or reminders can help ensure timely payments.

Another approach is to reduce your credit utilization ratio by paying down outstanding debts and avoiding high credit card balances. Aim to keep your credit utilization below 30% of your total credit limit. Additionally, try to maintain a diverse credit portfolio by responsibly managing different types of credit accounts.

It’s also important to avoid opening too many new credit accounts at once, as this can temporarily lower your score. Instead, focus on building a long credit history with a few well-managed accounts. Regularly checking your credit report for errors and disputing inaccuracies can also help improve your score.

Conclusion: The Path to Better Financial Health

In conclusion, regularly checking your credit score and understanding the factors that influence it are essential steps towards achieving better financial health. By staying informed about your credit score, you can make more strategic financial decisions and improve your creditworthiness over time.

Taking proactive measures to enhance your credit score, such as maintaining a positive payment history, managing debt wisely, and diversifying your credit portfolio, can lead to significant benefits. These include access to better loan terms, lower interest rates, and increased financial opportunities.

Ultimately, a strong credit score is a valuable asset that can open doors to a brighter financial future. By prioritizing regular credit score checks and adopting responsible financial habits, you can ensure that your credit score reflects your true financial potential.